Management accounting is a very broad concept. Wikipedia describes it as an orderly system for identifying, measuring, collecting, registering, interpreting, summarizing, preparing and providing information that is vital for making decisions on the organization’s business and management processes.

The main objective of management accounting is to show planned and actual outcomes according to the financial model of the organization for the purpose of making management decisions. But how can we take into account all the associated factors and risks in building a financial model?

Who the article is for

This article will be of interest to senior managers, project managers, financial managers and anyone who is involved is some way or other in the process of calculating the profitability of software production.

Disclaimer

This article is not a cure-all, but merely a description of the management accounting model that we use to forecast business finance (Evgeniy Lobanov, COO, AGIMA).

Management Accounting Model

Previously, we didn’t think in too much depth about how to use and forecast management accounting. We had several related Excel tables with all cash flows taken into account, but it wasn’t helpful in making management decisions. The planned and actual outcomes often differ greatly. We decided to formalize the management accounting process and the procedure for working within this process. There are two main approaches to management accounting:

- By cash flow;

- By closed accounting statements;

The second approach is correct, taking into account only closed statements, both in terms of revenue and costs. Accounting in terms of cash flow does not reflect the actual financial model of the company. You could face an unforeseen situation. For example, you failed to fulfill the terms of an agreement and so the client took back the advance payment (and the payment has already been allocated or distributed). At AGIMA, cash flow is a separate system that is much simpler than management accounting, and one that we will describe in detail in the next article.

Under the terms of the contract with major clients, there is a deferral of payment from 60 to 90 business days, which means that you will receive the payment for your services in two or three months. We consider the work completed after receiving all statements. Closed statement = closed work. It is the same with costs. For example, furniture was paid for in September (the depreciation period is regulated by the Law), but we will receive the statement next month. This means this cost will be accounted for in October, even though the money was already debited from our account (it is possible to draw up a substantiated refusal of the statement next month and take the full cost of the furniture).

- All incurred costs, including all direct and indirect costs of internal specialists and outsourcing.

- All forecasts for possible future costs, including forecasts for an increase in the employee payroll, office scaling, taxes, etc.

- We only focus on the scope of work already confirmed by documents, without taking into account potential orders.

- We maintain a separate record of all transits; the purchase amount and the mirror amount of sales should not be taken into account in the calculation of employee motivation.

For example, we completed works for a conditional amount of 100 rubles, while our costs amounted to 50 rubles. Here, the profitability of the task is 50%. If, for example, 100 transit rubles are added, for a 1C-Bitrix license with a 1C-Bitrix purchase price of profitability will be 25%. This is a deliberate deterioration in profitability, even though nothing actually has happened.100 rubles, the cash flow should not affect management accounting. Management accounting must completely coincide with the accounting statements (P&L), down to the last penny; otherwise neither method can be reliable.

Procedure for working with the management accounting model

The procedure for working with the management accounting model consists of five main steps:

1. Forecasting the scope of incoming work.

2. Validation and cost planning.

3. Calculation of quotas.

4. Determining a planning horizon.

5. Recording the result for previous periods

1. Forecasting the scope of incoming work

We validate accounting incoming works and determine the probability of risk occurrence and the degree of risk impact on the stages of these works. We minimize the risks where possible and record a clear path to minimization, or we carry out these works in the period of time for which we are building the model.

We forecast the direct costs for the given scope of works on the basis of the profitability ratio, which is included in the rates for each project involved in the scope of works. In our company, this is the responsibility of the project office specialists and the financial department.

We forecast all quotas for indirect costs based on retrospective data from the previous year, and increase them depending on the planned sales volume. If the sales volume this year is 1.5 times the previous year’s volume, we multiply the costs of creating quotas for the next period by a default of 1.5 (this applies to all indirect and non-production costs: HR, PR, etc.).

What else to take into account:

It is necessary to ensure the maximum level of detail for the entire project in terms of stages, which are closed by statements. Ideally, each stage closed by a statement should not last more than a month. Otherwise, if a team works on one stage for three months, only the last month will be profitable, while the two previous months will be «in the red».

Several major customers are not willing to close financial statements every month, so it is worthwhile to provide for «intermediate» ones: «signing terms of reference», «signing a concept», «signing a prototype set», etc. Officially, they have less evidence that the works have been completed and accepted than according to an accounting statement, however, it is possible to see the client’s satisfaction with the finished result immediately. In addition, you will be able to measure the team’s profitability each month.

It is important to record the profitability not only for the project as a whole, but also for each stage of works in each production unit, from the company department to the final specialist. We measure the profitability of both the company and of each division. We look at the profitability of subdivisions within divisions, and in the subdivision, each team leader/art director and a specialist in their team. We also calculate the specialist’s performance rate based on their salary (including Personal Income Tax and Unified Social Tax) + fixed indirect costs per head + planned profitability ratio.

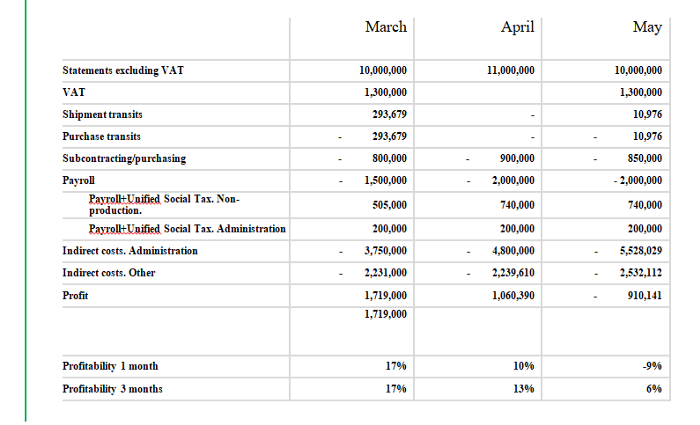

Important: we do not include VAT neither in the volume nor in the costs. This can be seen in the example of a report from our management accounting system.

Upload of a report from our management accounting system. The amounts were changed. We generate these reports for each unit.

2. Validation system for plans and forecasts

We assign work stages one of three statuses:

1.Plan (all documents are available; a contract and purchase orders have been executed/signed).

2.Forecast (work has been estimated/confirmed by the customer, but no documents are available. Contract in the negotiation stage with the customer’s legal representative).

3.Opportunity (there is no confirmation or documents, and the standard statistical deviations are considered).

The management accounting process considers only the plan and forecast for the work stages, excluding opportunities (the latter is used in sales-related procedures).

We define all stages of work and validate the applicable time frames:

- We make weekly snapshots for each project from the project office and the production side. These consider the internal deadline of the stage, including validation of deadlines for each task within the stage, taking into account the time for customer acceptance and business testing of tasks.

- We determine the probability and degree of the impact of risks on each stage of work.

- We distinguish three risk levels: no risk, probable risk, and probable risk with maximum impact on the stage (the risk map was discussed in detail in the article on ideal time planning).

- For the risk management of each stage, we work on a priority basis.

The main priority of risk management is the scope of the task, incidental «long money» (continuous work and workload over an extended period of time) and work that can be used as a case of interest. If the scope is small and the task is not of interest to us, this work may be omitted in management accounting for the purposes of conducting the risk management procedure.

3. How to plan costs correctly

This is a key issue in management accounting. It is just as important as dealing with scope and revenue. The cost may be something necessary or something that will not help the company in any way (e.g., we are now installing an outdoor infrared heater for smokers. These costs will not impact the work of the company in any way, but it will provide heating for our colleagues that smoke).

We calculate and fix quotas for regular purchases, and we determine all cost items:

- We take into account all possible forecasts at once: scalability of hardware and administrative components, increase in payroll based on work results, indirect forecasts based on legislation.

- Non-production units of the company are also calculated based on the volume of incoming work.

- We enter quotas for each expense item.

We continuously account for production overheads and make sure that their ratio does not exceed 1.7. The ideal overhead ratio that we aim for is 1.5.

4. Calculation of quotas in expense items

We plan all costs for the year ahead, calculate and fix quotas for regular purchases, and determine all cost items. Again, we use historical data to forecast the costs, and increase the quotas depending on the planned sales volume.

To estimate the free budget for the planned profitability indicator, we use the following formula:

(Statements + transit volume) — (indirect + payroll + purchases + transit costs + profit margin).

The level of profitability for all companies operating in our market is company-specific, and varies within the range of 5% to 20%. We allocate the budget by expense items based on the forecast of profit per item.

5. How to determine the minimum planning horizon

First, determine the average sales cycle over the past year. To allow reasonable time for scaling, it is necessary to convert opportunities into plans and forecasts at least a month before starting work.

The longer the planning horizon is, the better. However, the shorter the sales cycle is, the shorter the horizon is and the lower the potential risks are. Since our average sales cycle is three to six months (we work in the high price segment and our customers have a long decision-making cycle), the minimum required planning horizon for AGIMA is three months. It is also important to validate the availability of work documents, record the preparation period and continuously monitor the conversion of work statuses from opportunities to plans and forecasts. This data is needed to build a model for the minimum planning horizon.

The larger the time gaps, the larger the minimum planning horizon should be. You cannot build a model for one month if the sales cycle is six, as the management accounting will be knowingly incorrect.

What do we gain?

When making managerial decisions, we are guided by numbers. Accounting makes it possible to build hypotheses. For example, if we take four office managers and enter the data into the payroll (forecasting indirect costs), we can see how the indicators change and the impact it has on the company’s economic performance.

If we see that the scope of work expected over a period of three months is significant and we will lack personnel for such work, we can start looking for new employees. Since the employee recruitment cycle varies from one to three months, the management accounting service sends us an alert in due time, prompting us to take action to prevent a collapse. By expanding the planning horizon, we identify more potential risks, which we include into the management accounting process so they can be handled in the necessary manner.

Benefits from efficient management accounting:

- We can quickly test hypotheses and make decisions.

- We additionally verify the appropriateness of the decision.

- We build profitability models for each production unit.

- We quickly identify bottlenecks and production crises.

- We strive to increase the planning horizon and forecast all potential risks as early as possible.

We believe that management accounting is the most important tool for tracking and boosting the financial status of any project or company. Build a competent management accounting process, increase your planning horizon and read more of our articles.